🗓️ Weekly Quotes: Tesla, Starbucks, Hermes, SAP, Coca Cola...

✅ [FREE] Analysing the Earnings Calls of Starbucks, Hermes, SAP, Tesla, Coca Cola, IBM, Flatex Degiro, Vidrala and Verallia.

🔥 Founder Offer! 30% off forever!

Upgrade to a paid subscription now and get 30% off forever!

👇 Simple, just use the link below and subscribe using the 30% discount code!👇

Last discount coupons, don't miss out on them!

🗓️ This week's earnings calendar

This week the following quality companies, selected by Quality Value, presented their results:

Flatex Degiro [FREE]: Last week, the American brokers IB and Charles Schwab reported, and this week their European counterpart, albeit on a smaller scale, presented its results. This is a stock we hold in our portfolio, and we’ve shared our opinion on the results.

SAP [FREE]: One of the best ERPs in the market. The German company continues to deliver strong results, showcasing its competitive advantage over the rest.

Tesla: We analyze the results of the car tech company. Its performance is a strong indicator of the overall automotive sector, particularly the electric vehicle market, charging infrastructure, and, more broadly, global economic trends and innovation. These results are very insightful to assess.

Hermes: one of the best luxury companies in history. You can see the summary of the press conference that we did last week of its comparable LVMH.

Starbucks: The coffee giant in troubled times—could it be a possible turnaround? We see it in the results.

IBM: The former American tech giant—what is its current state? We analyze it below.

Coca Cola: Finally, we have the beverage par excellence, one of Warren Buffett's greatest successes in his history. What is the current state of the business today? We will explore it through its results.

Vidrala and Verallia: We analyze the results of the glass oligopoly. We hold Vidrala in our portfolio, so we will provide a brief reflection.

Let's get straight to the point. 👇

✅ Summary and analysis of earning calls:

1- Flatex Degiro:

📊 Post-earnings share price performance:

🎬 General summary of the presentation by the Board of Directors:

Introduction: flatexDEGIRO conducted its 9-month results call, with new CEO Oliver Behrens sharing initial perspectives after recently joining the firm, while CFO Benon Janos provided detailed insights on Q3 performance.

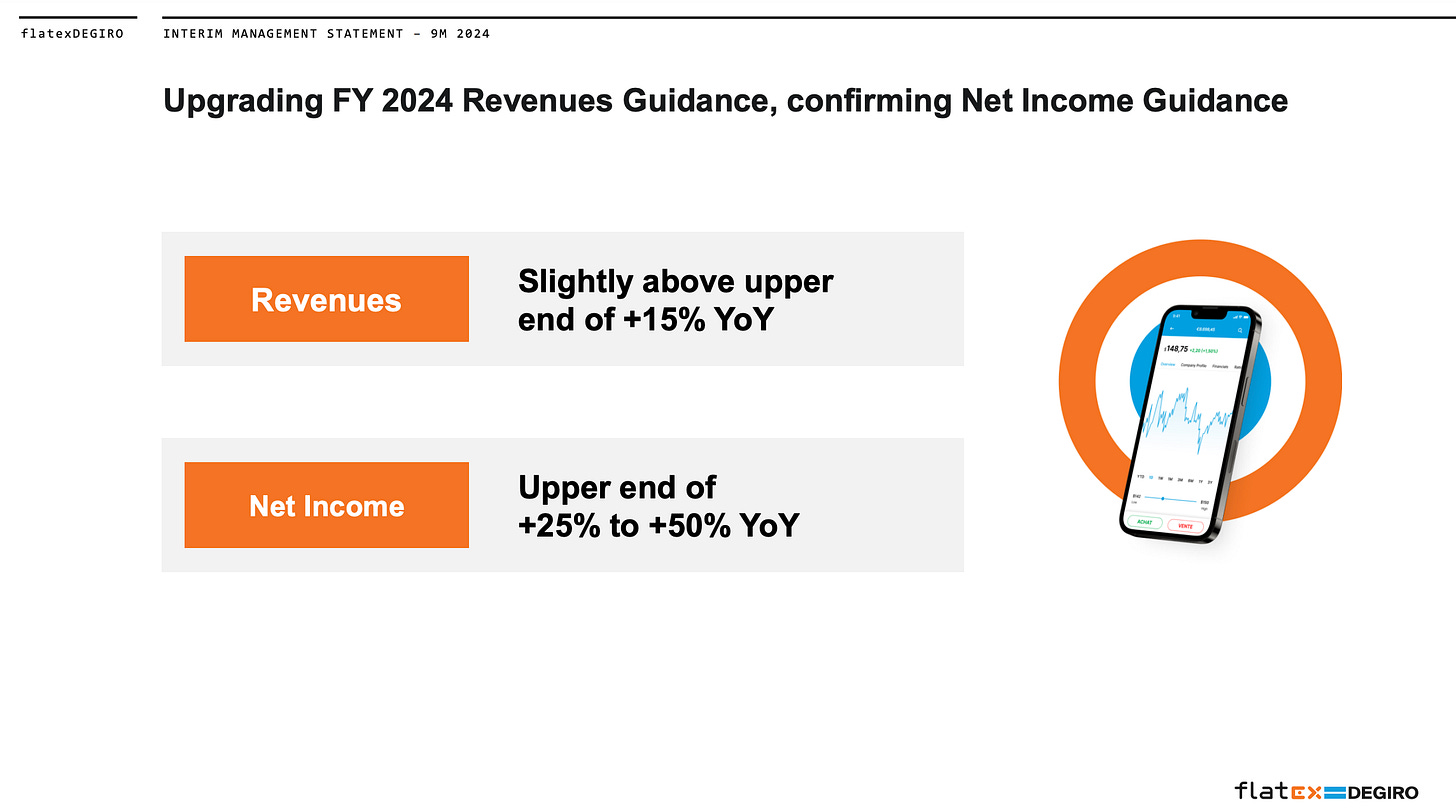

Revenue Growth: Revenue for the 9 months rose by 22% year-on-year to EUR 353 million, with a 15% increase in FY24 guidance, driven by both commission and interest income growth.

Profitability: EBITDA surged by 70% YoY, reaching EUR 152 million. Net income grew 111% YoY to EUR 86 million, showcasing strong scalability and a 74% margin increase.

Strategic Initiatives: flatexDEGIRO is focusing on expanding its product offerings, including direct cryptocurrency trading (initially in Germany), and plans for personal pension accounts as legislative changes may allow.

Operational Milestones: Successfully addressed regulatory requirements from BaFin, leading to the termination of BaFin's special commissioner mandate, a key compliance achievement.

Share Buyback: A share repurchase program commenced, with EUR 50 million allocated and EUR 7 million already spent, representing 14% of the program’s volume.

European Integration: Announced a reorganization to become a European SE entity in 2025, supporting its pan-European brokerage ambitions.

Customer Metrics: Achieved a record EUR 64.6 billion in assets under custody (+37% YoY) and customer additions increased 19% YoY, reinforcing flatexDEGIRO’s market positioning.

Cost Management: Targeting reductions in administrative expenses after Q3’s elevated costs, with plans to improve operating leverage through lower professional and consulting fees.

Future Guidance: Upgraded FY24 revenue guidance to slightly exceed previous upper limits and maintained net income guidance of up to +50% YoY growth.

🎙️ Summary of the questions and answers:

Admin Expenses Outlook: Targeting EUR 50 million+ in admin expenses for 2025, significantly reducing from 2024 levels. Q4 expected to see initial reductions, with a more sustained cost management strategy into next year.

Regulatory Oversight: Following the end of BaFin's special commissioner mandate, regulatory supervision is nearly normalized, with only minor findings remaining, which will be resolved in upcoming quarters.

Interest Rate Exposure and Income Strategy: flatexDEGIRO plans to offset potential declines in net interest income, due to ECB rate trends, by expanding product offerings like crypto trading and aiming for higher commission revenues.

Crypto Trading Model: Planned crypto offering is a white-label solution, initially launching in Germany. Expansion across platforms will follow, with a strategic positioning aimed at competitive pricing and measurable revenue impact.

Trading Activity: Q3 saw a decline, with September particularly weak. However, October trading has rebounded positively, indicating a potential uptick in Q4.

Marketing Spend: Slight increase in marketing spend anticipated for the crypto launch, already included in current budgets. Overall marketing for Q4 to fall between Q1 and Q2/Q3 levels.

Cost of Goods Sold Impact on EBITDA: Commission income generally generates a slightly lower margin than interest income. Impact on EBITDA will depend on shifts in income composition, which will be clarified in the FY24 preliminary results in February.

Potential Pricing Adjustments: Evaluating possible changes in margin loan and commission pricing for 2025, with details to follow after further internal discussions.

New Pension Product: Working on a new personal pension product, pending further legislative clarity from the German government. Moderate complexity, expected for launch by 2026.

Legal Structure Change to SE: Transition to a Societas Europaea (SE) form in 2025 to enhance operational flexibility, optimize governance options, and improve engagement with employee representation across Europe.

✅ Quality Value Opinion

The results are in line with expectations and even exceeded the sales guidance provided. Due to operational leverage, growth compared to the previous year is exceptional. However, we understand that the market’s concern stemmed from the absence of guidance for 2025. There’s some uncertainty about how sales will evolve, as one of their revenue streams—interest from deposits—is expected to decline due to falling interest rates. While we recognize certain risks, primarily related to internal power struggles (as outlined in this publication), we believe the company has potential for sustained double-digit growth over the next decade, given its strong product and untapped market opportunities.

📋Links to the investor relations website

2- SAP:

📊 Post-earnings share price performance:

🎬 General summary of the presentation by the Board of Directors:

Cloud and ERP Growth: Strong acceleration in total and cloud revenues. Cloud backlog increased 29% YoY, reaching €15.4 billion. Cloud ERP Suite growth surged by 36%, driving overall cloud revenue to €4.4 billion (+27% YoY).

Profitability: Operating profit rose by 28% YoY, reaching €2.2 billion. Non-IFRS operating margin stood at 26.5%, showcasing operational efficiency.

Predictability: 84% of revenues are now categorized as predictable, boosting long-term visibility.

Strategic Initiatives: Completed acquisition of WalkMe, enhancing SAP’s transformation portfolio. New customer wins in retail (Schwarz Group, Sainsbury’s) and tech (NVIDIA, Mistral AI).

AI Integration: Business AI drives innovation with 30% of cloud orders in Q3 involving AI. Expansion in AI use cases and launch of the SAP Knowledge Graph to strengthen GenAI capabilities.

Geographical Performance: Cloud revenue growth was particularly strong in EMEA and APJ regions, with standout performances in Brazil, Chile, Germany, and others.

Free Cash Flow: Free cash flow increased 44% YoY, reaching €1.2 billion in Q3, driven by profitability and lower tax outflows.

Outlook Raised: SAP raised 2024 guidance, forecasting an operating profit between €7.8-€8 billion, with continuous double-digit revenue and profit growth expected through 2025.

🎙️Summary of the questions and answers:

Order Intake: 60% of Q3 order intake was from large deals, significantly above the typical 50% for Q3.

Pipeline Strength: Dominik highlighted that SAP’s installed base continues to convert to cloud solutions, providing momentum and stability. Many large enterprises still haven't fully transitioned to the cloud, which presents continued upside potential.

Macroeconomic Impact: Despite global macroeconomic challenges, especially in Germany, demand for SAP's cloud ERP and transformation services remains strong. Clients view SAP’s solutions as essential for restructuring and productivity gains, especially in sectors like chemicals and automotive.

AI Deals: 30% of Q3 deals involved AI use cases, with AI providing pricing upside, especially in supply chain, manufacturing, and sourcing solutions. SAP’s premium offerings, such as RISE and GROW, are leveraging embedded AI to drive value for clients.

Future Expansion: SAP anticipates further land-and-expand opportunities with existing customers, as AI use cases expand across their portfolios. This positions SAP for sustained growth in AI and cloud services.

📋Links to the investor relations website

👇The summary of the transcripts of the following companies is exclusively for paid subscribers:

3- Tesla ($)

4- Hermes ($)

5- Starbucks ($)

6- IBM ($)

7- Coca Cola ($)

8/9- Vidrala & Verallia ($)

3- Tesla:

📊 Post-earnings share price performance:

🎬 General summary of the presentation by the Board of Directors:

From this point, the content is exclusive to paying subscribers. Subscribe now, take advantage of the launch offer, and gain access to all deals.

If you are a paying subscriber, remember that you only have to log in the first time and you will be able to see all transcript content in the coming weeks.